The fintech sector has been a leading source of tech startup success in the Australian market. The sector is also a clear example of how technology buyers are changing the way they interact with startups. While local fintechs originally emerged in competition to banks and financial institutions, enterprise IT leaders are now often working with fintechs to deploy products and services more quickly and cheaply, says FinTech Australia General Manager Rehan D’Almeida.

“I think banks in the last few years have changed their tone and are seeing much more opportunities to collaborate with fintechs,” D’Almeida told TechRepublic. “They are open to participation and seeing opportunities with fintechs, whether that’s investing in them, integrating them with their own systems, doing a full buy-out or other types of opportunities.”

An explosion in fintech-generated innovation over the last decade — combined with the possibilities created by cloud computing and software as a service — is helping to shift the mindset of tech teams at larger institutions. This is resulting in enterprise technology buyers using more fintech products and services together with in-house technologies to win over the end consumer.

Jump to:

- Fintech startups in Australia change from banking competitors to collaborators

- The growth of cloud computing and SaaS is changing what is possible for Australia’s fintechs

- Australia’s fintechs are challenging how financial institutions procure new technology

Fintech startups in Australia change from banking competitors to collaborators

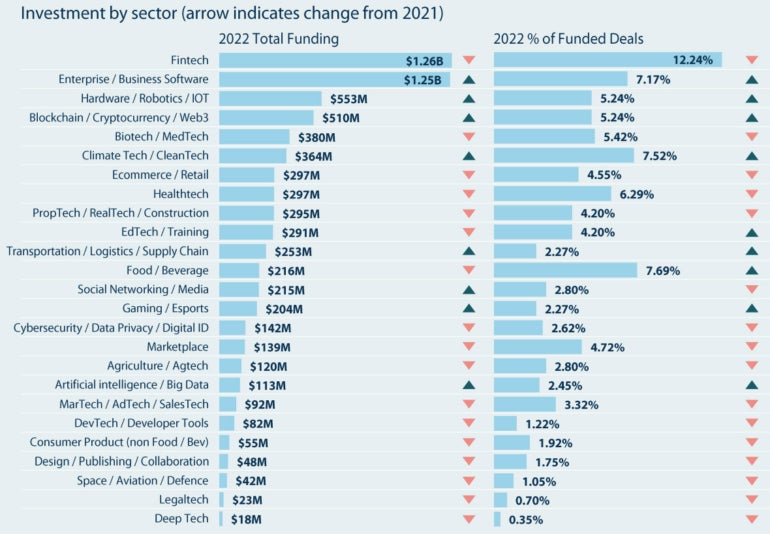

Venture capital investment in local Australian fintechs experienced a significant decline in 2022 to AU $1.26 billion (US $810 million), mirroring a correction seen in the U.S. and Europe. However, the sector still attracted higher investment than any other startup sector — just ahead of enterprise and business software startups in Cut Through Venture’s The State of Australian Startup Funding report (Figure A).

Figure A

The recent turbulence also didn’t stop FinTech Australia, the sector’s peak industry body, from holding its annual Intersekt conference in 2023. Covering a range of pressing industry issues, from utilizing consumer data in an open banking era, to the future of payments and the potential of AI, it drew over 1,100 attendees — and not just from the thriving startup ecosystem.

“There’s a much more diverse and broader audience now,” D’Almeida said. “We’re not just seeing fintechs attend, but more banks and financial institutions are also now participating.”

This represents a shift in the market. The early years of the fintech ecosystem were all about disruption. Instead of working together with large banks and financial institutions, ambitious startup tech players were instead seeking openings where they could use rapid changes in technology to disrupt the existing dominance of slower to move incumbents such as banks.

“They wanted to reach consumers directly. As the industry evolved, the opportunities have changed,” D’Almeida said. “Some fintechs have pivoted, some have seen more opportunities to partner rather than go direct, and are now reaching customers through the banks and larger institutions.”

Onboarding and fraud prevention platform FrankieOne is one example. Launched in 2017 with the aim of becoming the “next great neobank,” the team’s encounter with disjointed bank customer onboarding processes led to a business pivot. Now, it helps banks including Westpac, fintechs and regulated entities deliver better customer onboarding processes and experiences, including monitoring identity and fraud.

SEE: Here are the 5 top fintech trends you can expect to see in 2023.

“There has been an evolutionary change,” D’Almeida says. “There are several fintechs working with banks now. There is a sense fintechs no longer see banks as their biggest competition; they see them as potential customers and partners, and other fintechs as the competition.”

The growth of cloud computing and SaaS is changing what is possible for Australia’s fintechs

AWS Head of Strategy for Financial Services in Australia and New Zealand David Fodor has seen this evolution in how banks work with fintechs firsthand.

Formerly general manager of enterprise systems, services and operations at major bank National Australia Bank, he told the audience at FinTech Australia’s Intersekt23 conference that ” … in my experience working in that [bank] paradigm, we were of the buying posture where we would traditionally go with one of the big tech providers and ask them to provide an end-to-end solution.”

He said a lot had changed since then in what amounted to a “new world” for tech buyers.

“There has been a rapid evolution of much better microservices architecture, a much better ecosystem of APIs,” said Fodor. “Those two coming together on top of platforms like ours that provide a marketplace of many different SaaS vendors means that you can stitch together what we describe as a SaaS mesh extremely quickly and extremely efficiently.”

Fast access to SaaS technology can help banks stay agile

AWS is seeing bigger financial services players progressively move in that direction.

“We still work with a lot of organizations that have that build-orientated, proprietary solution type of mindset going in,” Fodor said. “Having said that, across a lot of Tier 2 and Tier 3 players in the market, and into the fintech ecosystem, it’s all about partnership. It’s about how to bring together best-of-breed solutions across the value chain, and we are enabling that to happen.”

Manu Iyer, director of BFSI and fintech at tech consultancy Thoughtworks, described one case study where a large financial services organization had wanted to create a personal lending product for the electric vehicle market.

Fodor said what would have taken three years and cost $45 million was pulled together in eight weeks, by bringing together AWS, real-time payment platform Zepto, consumer data firm Adatree and SaaS cloud banking platform Mambu. He added that the most important thing AWS does is help organizations be more agile.

“The most important thing is helping them access new technologies like artificial intelligence,” Fodor said. “That’s where it’s all happening — without a platform that allows you to access a marketplace of lots and lots of services, lots of third-party services, lots of partnerships, it’s hard to find a pathway to adoption of new technology as it comes on to the market.”

Australia’s fintechs are challenging how financial institutions procure new technology

Fintechs are challenging financial institutions to change the way they source and use tech. Mambu Global Solution Engineering Lead Perminder Grewal said the SaaS cloud banking provider’s experience with the procurement processes of larger institutions is that they often have an existing definition and criteria around what “core banking” is. She said this might not reflect what the institution requires to deliver better in today’s fast-changing market.

A traditional request for proposal process can also struggle to keep up with consumer change, the availability of ecosystem providers, or market developments and regulation, similar to the Consumer Data Right regime, under which consumers can now share data with providers they choose.

“We need to work with the business and tech areas of the banks to challenge what they are trying to do and get down to the nuts and bolts of what they need versus what they could have from a core: We work with a lot of banks to really understand what is their MVP,” Grewal said. “The time to revenue, to getting to that MVP is critical. Because you can analyze things to the nth degree and not have done anything two or three years later, or you can deliver something in nine months and iterate on that to get to the full functionality you need.”

Jill Berry, CEO and co-founder of Adatree, which has done a number of bank deals, said she appreciated when bank buyers know ” … what they want to own and what they don’t want to own.”

“When you talk to a tech team, a tech team often wants to build, Berry said. “They are like, ‘why can’t I build this?’ And you say, ‘Well you can, you can build anything, but it will probably just cost you a lot more money, time and effort. And it’s a question of opportunity cost.”

Fintechs are proving they can be strategic partners for the future

Key accreditations or deal history are helping fintechs be seen as the serious potential partners they are. For example, Zepto’s status as the first non-ADI, accredited CDR data recipient approved to connect directly to the New Payments Platform as a Connected Institution, has carried weight for enterprise customers looking for trusted SaaS providers. In 2023, Zepto also struck a deal with Wpay, the paytech development arm of retailer Woolworths Group, to deliver one of the first retail use cases for payments initiation services PayTo.

Fintechs are increasingly seeing their offerings resonate in financial services. Zepto CTO Rich Miller said the trend demonstrated a shift in the business and technology landscape — one that could see the fintech ecosystem playing a big role in the sector in years to come.

“It reflects the change in the business landscape towards more SaaS-based, more agile and more efficient and innovative solutions that can be brought to market really quickly and highly scalably,” Miller said. “The procurement shift is a shift from a more transactional-based style of procurement to one where it is much more about ongoing strategic partnerships.”