FreeAgent’s fast factsStarting price: $27/mo. Key features:

|

FreeAgent is an accounting software designed for small businesses. Originally started in the UK, FreeAgent has since expanded to the United States, joining the field of reasonably priced accounting software.

In this FreeAgent review, we examine its many features and summarize the main pros and cons to consider. We also offer some FreeAgent alternatives to help you choose the right accounting software for your business.

FreeAgent’s pricing

FreeAgent offers one single pricing plan for U.S. businesses:

- New sign-ups pay $13.50 per month for the first six months, and then the price increases to $27 per month after the 50% sign-up discount period ends.

There are no contract or setup fees, though FreeAgent does charge an additional $6 per month for its optional Smart Capture Unlimited feature (for receipt capture). A 30-day free trial is available and it does not require a credit card to test out the software.

FreeAgent’s key features

Dashboard and design

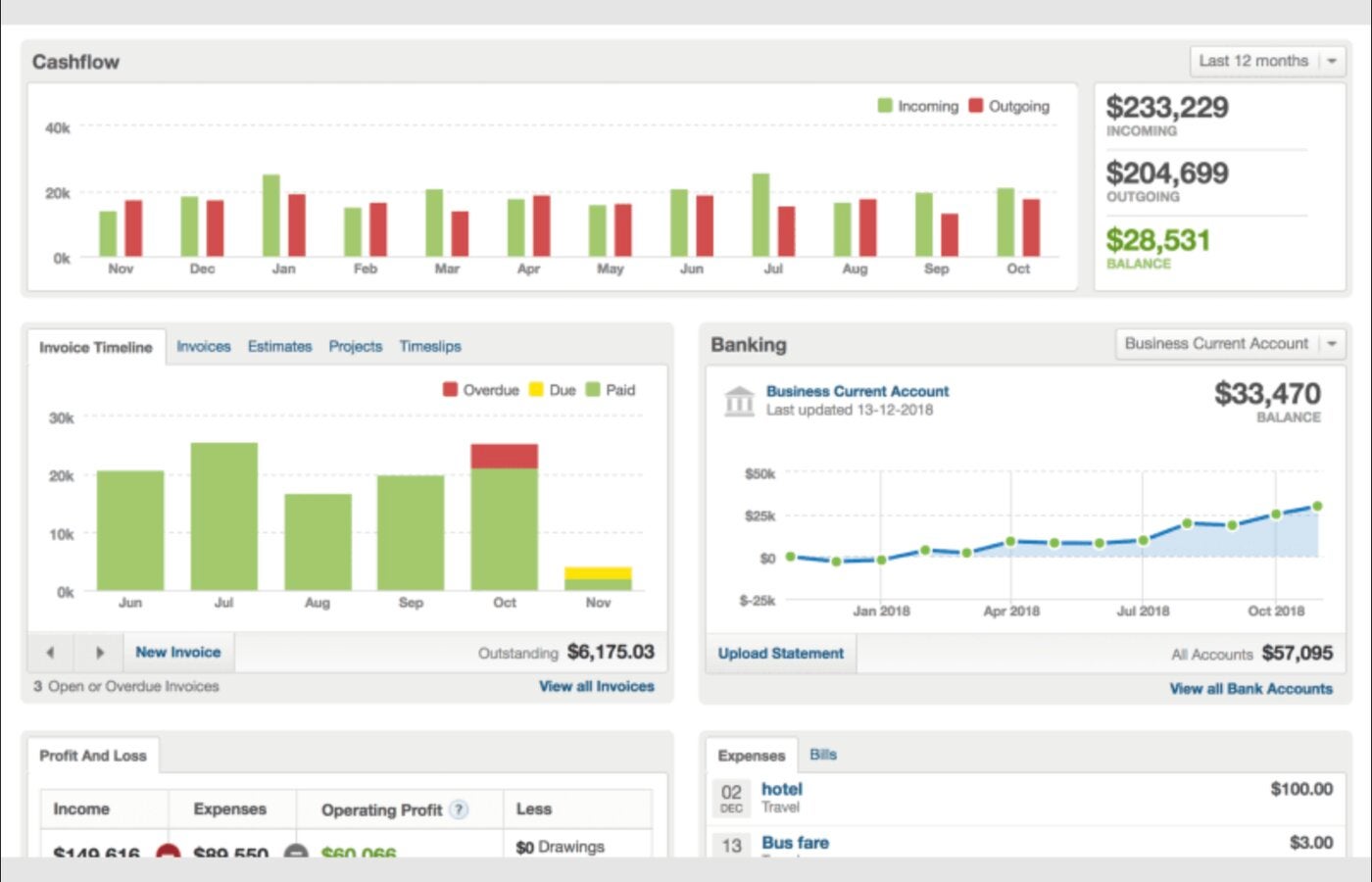

FreeAgent’s dashboard combines an overview of all the modules into one single page, pictured below. At the top of the dashboard is your incoming and outgoing cash flow chart. Below on the right is a module that shows your most recent invoices, estimates and projects, and underneath that, you can view your most recent expenses and upcoming bills as well.

To the left, you’ll see a banking module that shows your cash levels for all your accounts combined. Below that, you can look at a slightly more detailed breakdown of profit and loss as well as upcoming tax timelines for your location.

Invoices and estimates

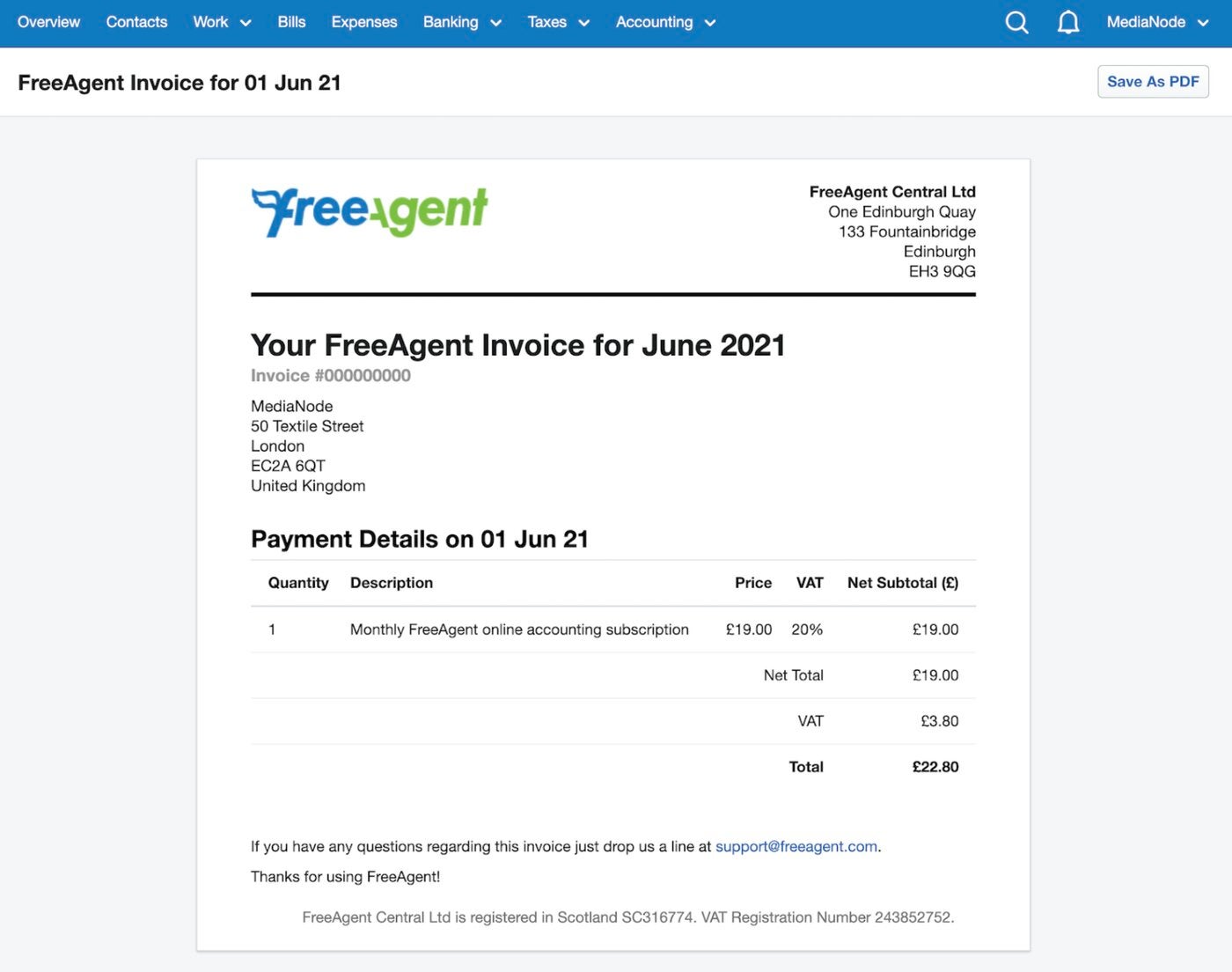

FreeAgent comes with eight prebuilt invoice templates to choose from, or you can create a completely custom one if you’d like. Once you’ve decided on a template, simply add your logo and fill in all the details. After the invoice is finalized, you can email it as a PDF to your clients.

FreeAgent does offer the option to set up recurring invoices that will be sent automatically, and you can remind clients about late payments with automated nudges. FreeAgent also allows you to create an estimate using those same templates and then quickly convert it to an invoice later, once it’s approved. If you want your clients to be able to pay you online, FreeAgent connects with PayPal, Go Cardless and Stripe, and it also allows for direct debit payments.

Bill management

FreeAgent makes it possible to track outgoing money with the bill management module. To create a bill, you’ll first need to create a contact, then fill out the date and financial information for the bill. You can link a bill to a project, set it up to reoccur and even attach a file to add more information. Once your bill is finalized and saved, it will appear on the Bills section of the dashboard, so you can keep an eye on your upcoming payments.

Expense and mileage tracking

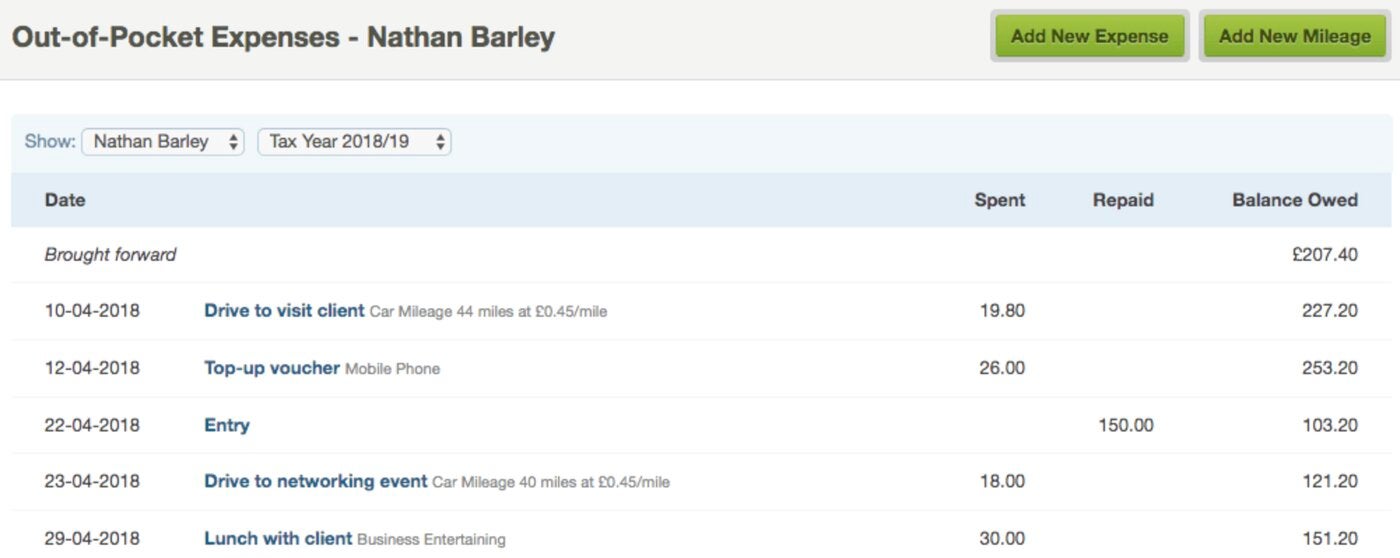

FreeAgent also comes with expense tracking so you can stay on top of out-of-pocket expenses and get reimbursed. You can add these expenses manually using the desktop version, or you can use the mobile app to snap photos of receipts and add them automatically. However, keep in mind that this mobile receipt capture function does have an additional cost of $6 per month.

FreeAgent also allows you to manually enter mileage tracking on both the desktop version and the mobile app. However, the accounting app is not GPS enabled, unlike many competitor apps, which means you cannot automatically track your business-related trips.

Project and time tracking

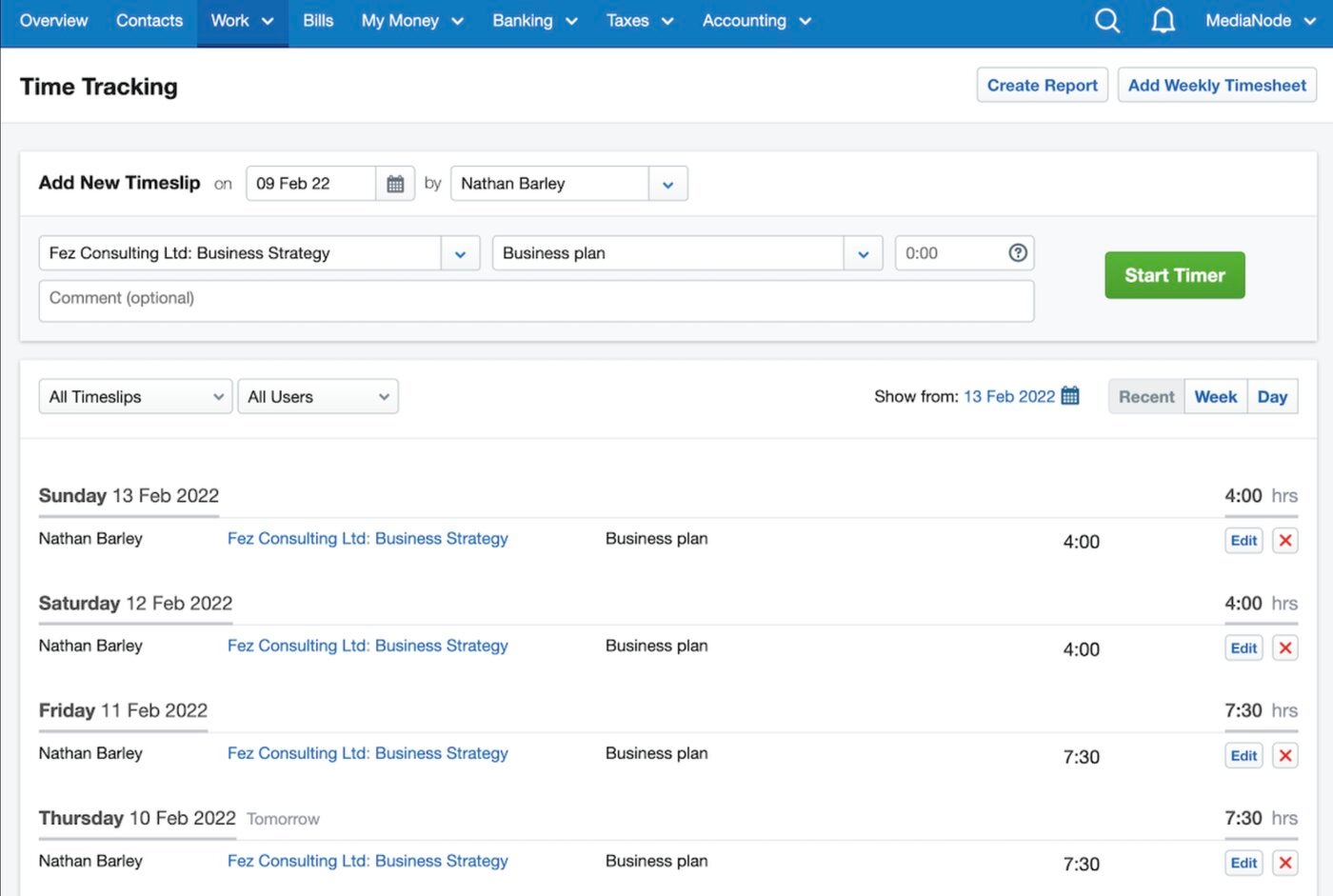

You can track time in FreeAgent using either the desktop or the mobile app. Since some other accounting software (such as QuickBooks) limit time tracking to the more expensive plans, this is a nice feature to have, especially at FreeAgent’s price point. You can use the built-in timer to track time as you work or enter time slips manually after the fact.

Each time entry can be assigned to a specific project, which makes it easy to generate an invoice for unbilled time and send it to the correct client. FreeAgent also allows you to track multiple things besides time to a specific project, including invoices, estimates, expenses and tasks.

Banking information

FreeAgent connects to most of the popular banks, including Bank of America, Wells Fargo, Chase, SunTrust and more. After you get those connections set up, the software will automatically import your bank transactions each day to make reconciliation easy. You can also upload electronic bank statements manually using various different formats, including AFX, QI and CSV. As the software learns your preferences, it will start to automatically categorize new transactions based on your previous selections to cut down on repetitive manual work.

Sales tax calculations

Calculating sales tax is a time-consuming hassle, but FreeAgent handles it for you. Simply set your sales tax rate and FreeAgent will apply it to all required sales and purchases. If you need to support multiple sales taxes, you can add as many different state sales tax rates as you want and also mark them as compound when necessary. The software also provides 1040 Schedule C reporting for sales tax so you can rest assured you’re compliant come tax time.

Reporting

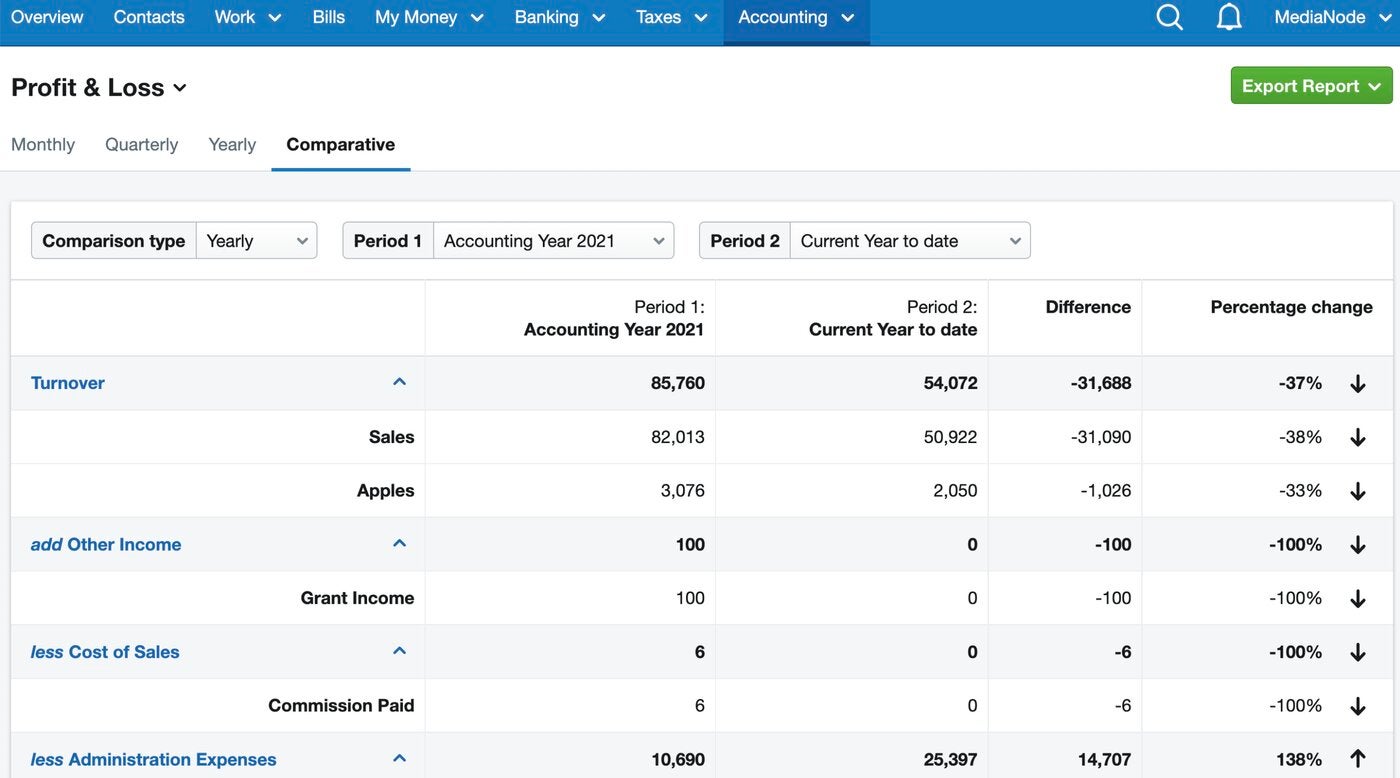

FreeAgent comes with 11 different accounting reports built into the software. These cover all the basics of accounting, including profit and loss statements, balance sheet, customer sales and bank reconciliation. These reports will suffice for most small businesses, but FreeAgent does offer fewer accounting reports than some other competitors, such as QuickBooks. If you were looking for numerous detailed accounting reports, you might want to check out an alternative software.

FreeAgent pros

- Unlimited clients and invoices.

- Single transparent pricing plan.

- Time tracking included.

- Automatically imports bank transactions.

- Easy to set up and navigate.

- Excellent invoicing and estimate tools.

- Free trial available.

FreeAgent cons

- Customer support based in the UK.

- Charges extra for mobile receipt plan.

- Single pricing plan doesn’t offer scalability.

- Relies on Zapier for many integrations.

- Mobile app doesn’t track mileage automatically.

FreeAgent alternatives

| FreeAgent | Xero | Wave Accounting | QuickBooks Accounting | |

|---|---|---|---|---|

| Unlimited invoices | Yes | Not on cheapest plan | Yes | Yes |

| Mobile receipt capture | Additional fee | Yes | Not on cheapest plan | Yes |

| Automatic mileage tracking | No | Yes | Yes | Yes |

| Starting price | $27 per month | $15 per month | $16 per month | $30 per month |

Xero

Xero offers not one, not two, but three pricing plans to choose from, making it a highly scalable solution for growing businesses. Entry-level pricing plans start at just $15 a month, though you will be limited to 20 invoices and five bills per month on that tier. Both bill and receipt capture are included in all pricing plans, as well as automatic sales tax calculations. However, you will need to upgrade to more expensive plans for more advanced features like project tracking and analytics.

Wave Accounting

Wave Accounting does offer a forever free accounting plan, but the features are quite limited. You’ll need to upgrade to the software’s Pro plan, which costs $16 a month, to automatically import bank transactions and digitally capture unlimited receipts, among other things. If you were looking for a more affordable alternative to FreeAgent that offers many of the same features, then the paid plan at Wave Accounting is well worth looking into.

QuickBooks Online

QuickBooks is the gold standard in small-business accounting software, but that reputation comes at a price: Paid plans start at $30 per month, which is definitely on the more expensive end. However, there’s no denying that QuickBooks offers all sorts of advanced features, including dozens of accounting reports as well as inventory management, depending on which plan you sign up for. If you’ve got the money to spend on it, QuickBooks is a great solution for those looking for fully featured accounting software.

Review methodology

To review FreeAgent, we signed up for a free trial of the software. We also consulted product documentation and user feedback during the writing of this review. We considered factors such as pricing, user interface design, customer support and integrations. We also weighed features such as invoicing, estimates, expense tracking, mileage tracking, bill management, time tracking, bank connections, sales tax calculations and accounting reports.