Patriot Accounting and QuickBooks Online are frequently recommended as top choices for small-business accounting software. While these platforms may seem very similar at first glance, a closer inspection reveals the differences between them.

In this review, we compare Patriot Accounting vs. QuickBooks Online to weigh the pros and cons and help you decide which one is the right choice for your business.

Patriot Accounting vs. QuickBooks: Comparison table

| Patriot Accounting | QuickBooks | |

|---|---|---|

| Starting price | $20/mo. | $30/mo. |

| Invoices | Yes | Yes |

| Expense tracking | Yes | Yes |

| Mileage tracking | No | Yes |

| Time tracking | Yes | Add-on |

| Inventory management | No | Yes |

| Third-party integrations | No | No |

| Payroll add-on | Yes | Yes |

| Try Patriot Accounting | Try QuickBooks |

Patriot Accounting vs. QuickBooks: Pricing

Patriot Accounting

Patriot Accounting offers only two pricing plans to choose from:

- Accounting Basic: $20 per month for unlimited users.

- Accounting Premium: $30 per month for unlimited users.

You should know that Patriot Accounting has more limited features than many other competitors, so its “premium” plan is more on par with entry-level plans from QuickBooks and other alternatives.

For more information, see our full Patriot Accounting review.

QuickBooks

QuickBooks Online offers four different pricing tiers to choose from:

- QuickBooks Simple Start: $30 per month with access for one user.

- QuickBooks Essentials: $60 per month with access for up to three users.

- QuickBooks Plus: $90 per month with access for up to five users.

- QuickBooks Advanced: $200 per month with access for up to 25 users.

First-time QuickBooks customers can choose to explore QuickBooks without committing to a plan by signing up for a 30-day free trial. You can also skip the free trial in favor of locking in 50% off for your first three months — but you can’t choose both.

For more information, see our full QuickBooks Online review.

Patriot Accounting vs. QuickBooks: Feature comparison

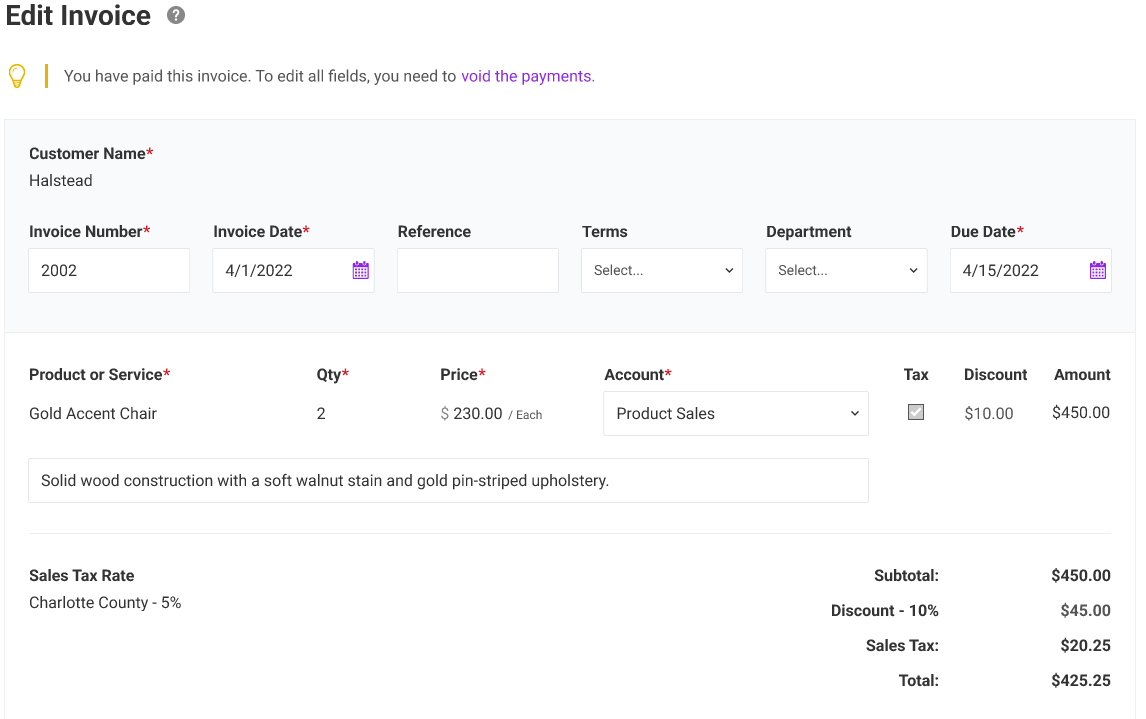

Invoicing and estimates

Patriot Accounting supports unlimited invoices and customers on all plans, which makes it stand out from other accounting software that limits these numbers for entry-level customers. However, you must upgrade to the Premium plan if you want the ability to create estimates, schedule recurring invoices, send invoice payment reminders, or customize invoice templates with your brand colors and logos.

QuickBooks also supports unlimited invoices and clients, but it includes far more customization and template options. All users can create estimates and quotes, then later convert them to invoices after approval. They can also track the status of each invoice, enable the option to add a tip and automate recurring invoices. If you don’t have time to put together a full invoice, then request money with the quick payment feature to get paid faster.

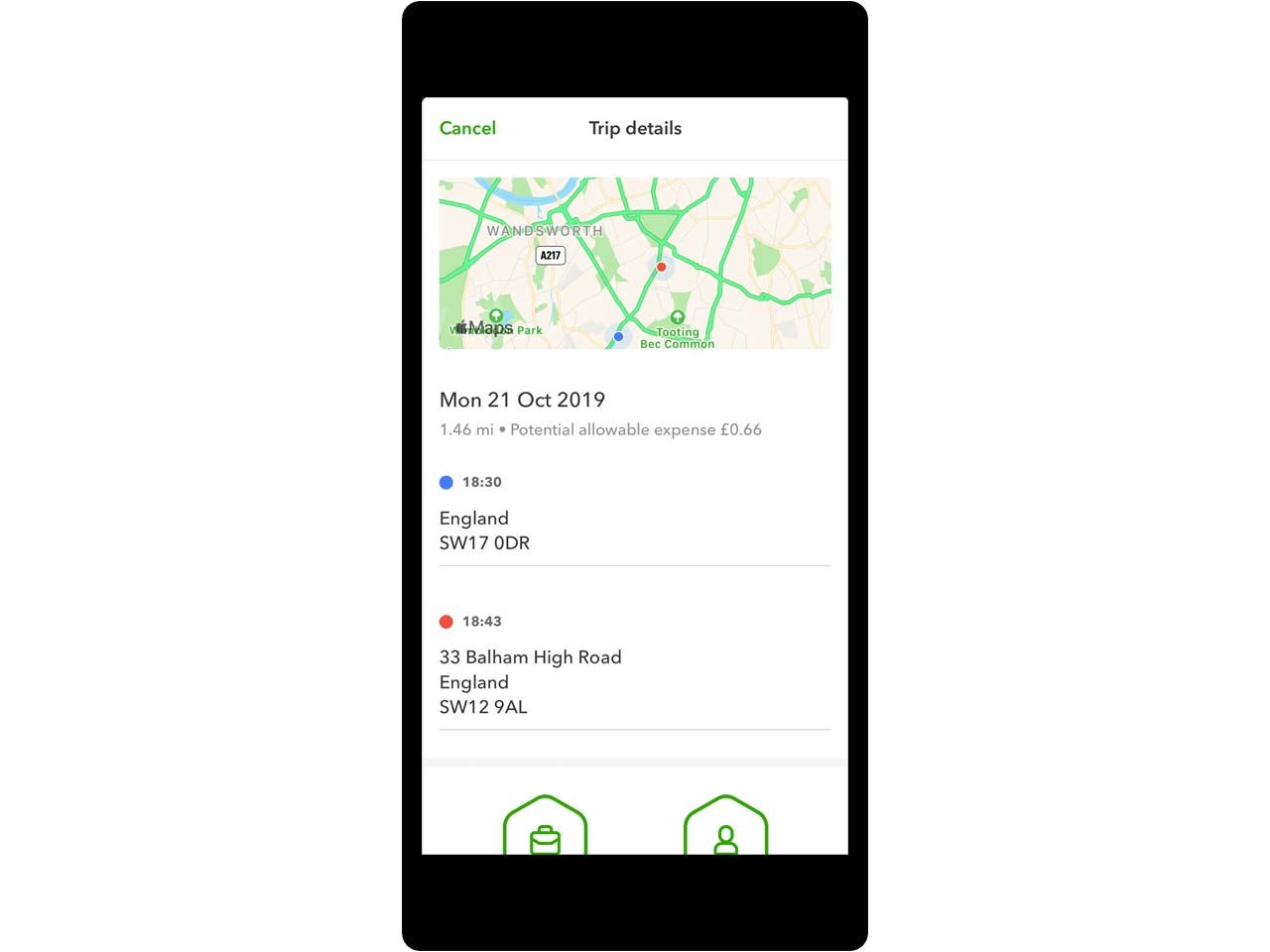

Expense and mileage tracking

Patriot Accounting offers limited expense tracking but not mileage tracking, largely because it doesn’t have a mobile app, which means no GPS tracking for drives. To track expenses, first set up a chart of accounts, and then Patriot will track incoming and outgoing transactions for each account type. If you upgrade to the Premium plan, you can upload pictures of receipts that you’ve taken, but its mobile receipt capture isn’t that sophisticated.

QuickBooks offers both expense tracking and mileage tracking for all pricing plans, somewhat of a rarity for accounting software. The mobile app means you can quickly snap a photo of a receipt and upload it to create an expense (or add to an existing one). QuickBooks offers many different ways to categorize expenses, with 18 different categories. You can also use the app to accurately track mileage using GPS and classify trips as business or personal.

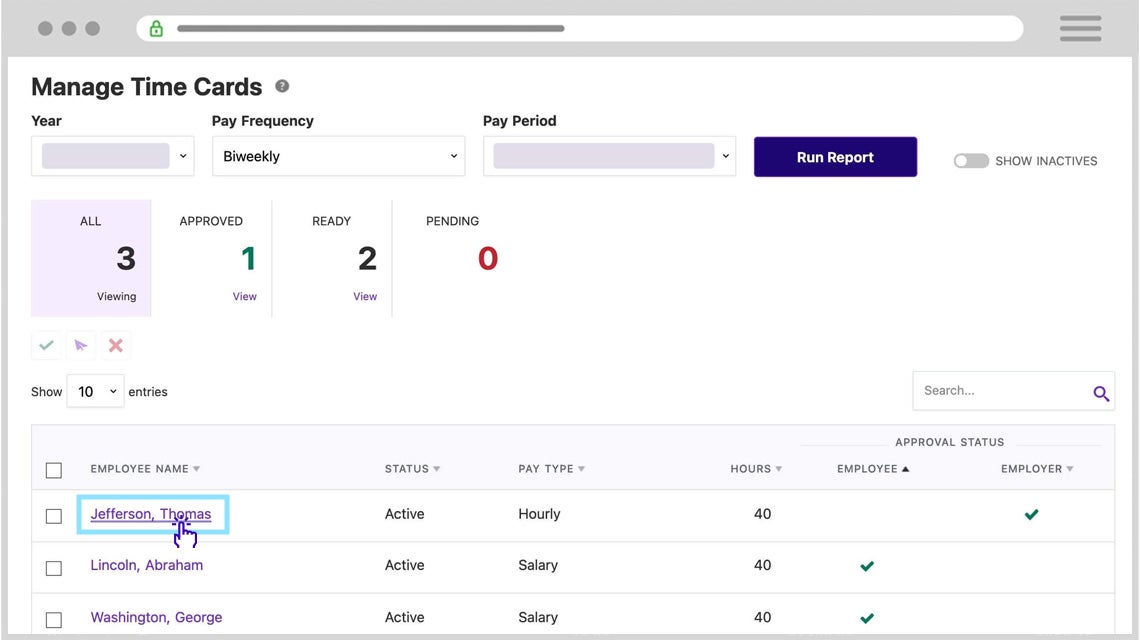

Time tracking

Patriot Accounting does offer a time and attendance solution, but it’s a separate add-on that is designed to work with the payroll system. It costs $6 per month plus $2 per employee per month. Patriot doesn’t really have a way to track your time and then add it to invoices, which might be a drawback for freelancers and business owners who charge by the billable hour.

Meanwhile, QuickBooks allows anyone on the Essentials plan to enter time and add it to invoices. You can also give your team permission to add their own hours and generate profitability reports to see how much money you’re making. For additional time tracking features, you’ll need to add on QuickBooks Time, which starts at $40 per month.

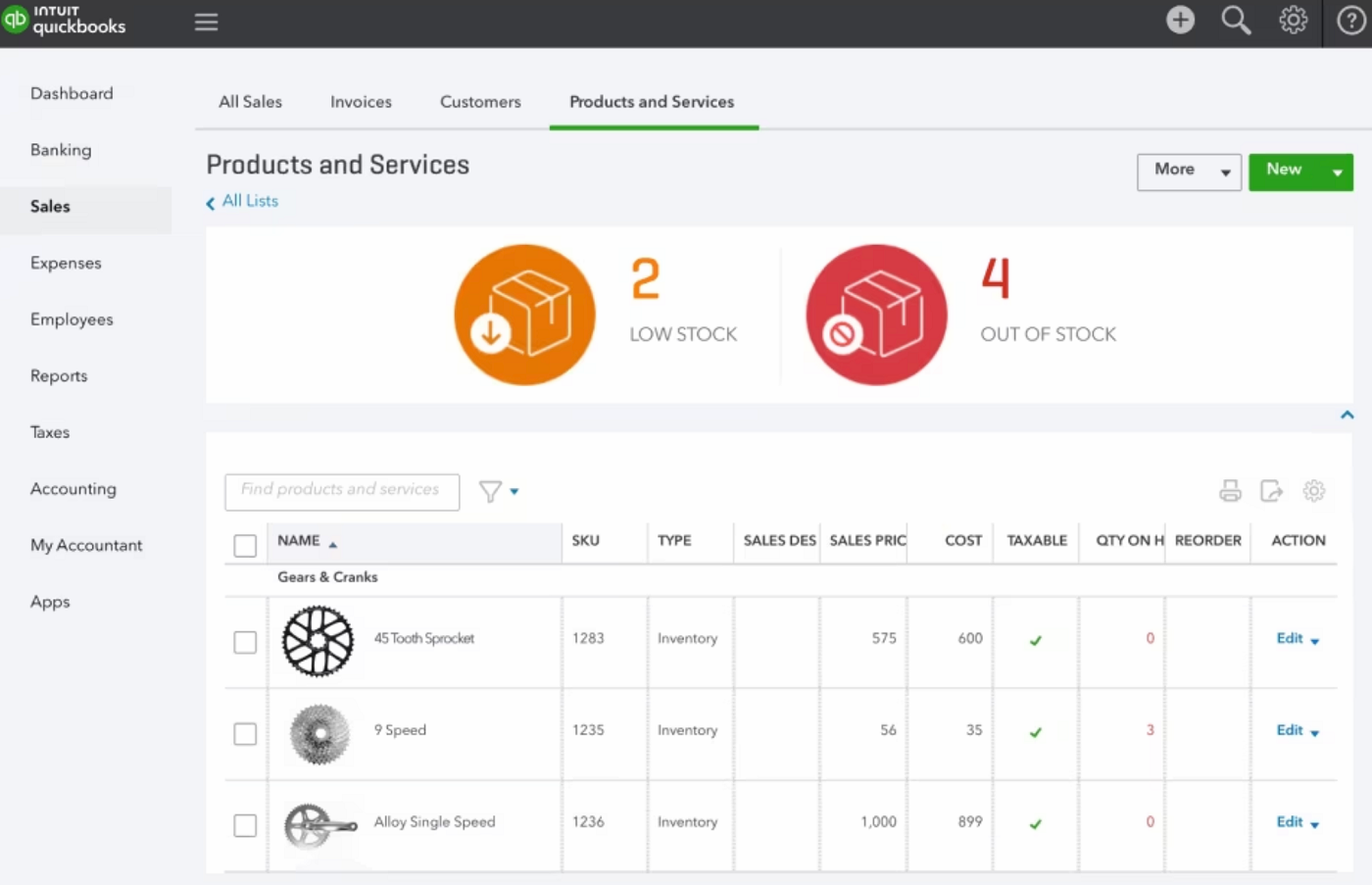

Inventory management

Patriot Accounting does not offer any inventory management features on any of its pricing plans. Businesses that sell products and physical items will need to seek out a separate inventory management solution. Keep in mind that Patriot Accounting doesn’t offer third-party integrations, so any inventory management solution you choose won’t be able to connect to your accounting system.

QuickBooks offers a robust inventory management system on its Plus and Advanced pricing plans. The software will send out low stock and out of stock alerts as products sell and also generate inventory reports so you can see what items are selling. It will also convert purchase orders into bills whenever new inventory arrives. It also connects with popular ecommerce platforms like Amazon, Etsy and Shopify.

Integrations

Patriot Accounting does not offer any integrations outside of its own payroll and time tracking solutions, which greatly limits the utility of the software. Meanwhile, Quickbooks integrates with over 750 popular business apps, making it highly likely that you will be able to connect your entire software stack to QuickBooks.

Payroll add-on

To wrap up this section, we wanted to point out that both Patriot and QuickBooks offer their own payroll add-ons. While investigating payroll software is outside the scope of this review, since we’re focusing on accounting software here, we do have an in-depth comparison of Patriot Payroll vs. QuickBooks Payroll to help you decide which one is right for your business.

Patriot Accounting pros and cons

Pros of Patriot Accounting

- Customer service is very well-reviewed.

- Unlimited invoices, clients and users on all plans.

- Free 30-day trial available.

- Less expensive than QuickBooks.

- Lower learning curve compared to more advanced alternatives.

- Payroll and time tracking add-ons available.

Cons of Patriot Accounting

- Accounting features are limited compared to QuickBooks.

- No third-party software integrations.

- No mileage tracking or time tracking included.

- No inventory management.

- No mobile app.

QuickBooks pros and cons

Pros of QuickBooks Online

- Familiar to most accountants and bookkeepers.

- Many invoice template and customization options.

- Mobile receipt capture offered for all plans.

- Mileage tracking through the mobile app.

- Unlimited invoices, clients and bills on all plans.

- Advanced inventory management features.

Cons of QuickBooks Online

- Expensive compared to Patriot Accounting.

- Must choose between a free trial and 50% off the first three months.

- Customer service could be improved.

- Least expensive plan does not support time tracking.

- Limited to 25 users even on the most expensive plan.

Should your organization use Patriot Accounting or QuickBooks?

Choose Patriot Accounting if . . .

- You need unlimited users for your accounting software.

- You are looking for a budget-friendly small-business accounting software.

- Your accounting needs are simple and you don’t need advanced features.

- You want excellent customer service.

- You don’t need mileage tracking or inventory management.

- You don’t care about third-party integrations.

Choose QuickBooks if . . .

-

- You need more advanced accounting features and are willing to master a higher learning curve.

- You have a larger budget for accounting software.

- You want more invoice templates and customization options.

- You need mileage tracking or inventory management.

- You want more detailed reporting and analytics.

- You want access to third-party integrations.

Methodology

To compare Patriot Accounting vs. QuickBooks Online, we took advantage of video demonstrations, product documentation and user reviews. We considered features such as accounting, estimates and invoices, expense tracking, inventory management, time tracking and reporting. We also considered other factors like pricing plans, ease of use, user interface design and more.